As the 2026 tax season gets closer, many Americans are already wondering when their refunds will arrive. For many families, a tax refund is not just extra money. It often helps cover rent, medical bills, school expenses, or credit card payments. With living costs still high, knowing when a refund may come is important for budgeting and financial stability.

The Internal Revenue Service is expected to start accepting 2025 federal tax returns in the last week of January 2026. Taxpayers can prepare their returns before that date using tax software or professional help, but the IRS will not begin processing them until the system officially opens. Preparing early can help you stay organized, but it does not mean you will receive your refund before the filing season begins.

The regular filing deadline is April 15, 2026, unless the government announces a change. Filing close to the deadline does not usually lead to faster refunds. In fact, the IRS often handles a large number of returns in March and April, which can slow processing times.

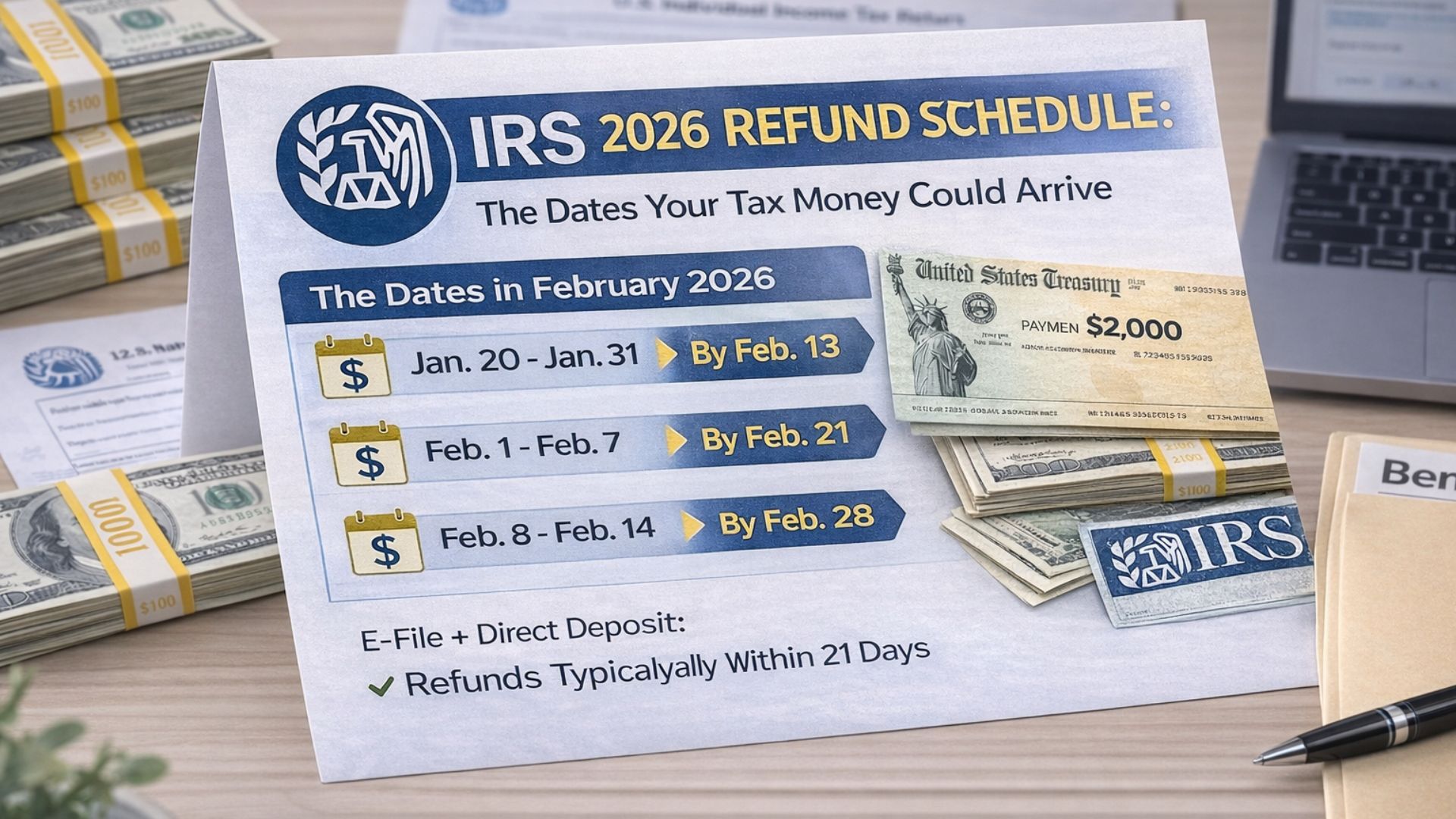

Refund timing depends on how and when you file. Electronic filing combined with direct deposit remains the quickest method. Paper returns take longer because they must be reviewed manually. If you choose to receive a paper check instead of direct deposit, delivery can take additional time.

Accuracy is just as important as filing early. Even small mistakes, such as incorrect income numbers or mismatched Social Security details, can cause delays. Returns that need manual review may take weeks longer to process.

Some tax credits also affect timing. Refunds that include the Earned Income Tax Credit or the Additional Child Tax Credit are held until mid-February by law. This delay happens every year, even if the return is filed correctly and on time.

The IRS also performs security checks to prevent fraud and identity theft. These checks help protect taxpayers, but they can sometimes extend the waiting period.

Taxpayers can track their refund status using the official “Where’s My Refund?” tool. Electronic filers usually see updates within 24 hours after acceptance. Once a refund is approved and sent, direct deposits typically arrive within one to three business days.

In most cases, electronic refunds are issued within about 21 days if there are no issues. Filing early, reviewing details carefully, and choosing direct deposit offer the best chance of receiving funds on time.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. IRS policies, refund timelines, and eligibility rules may change. Individuals should consult official IRS resources or a qualified tax professional for advice related to their personal situation.