Waiting for a tax refund can feel stressful, especially after your status changes to “refund approved.” For many families, a refund is not extra spending money. It is often used to pay rent, catch up on bills, reduce credit card balances, or rebuild savings. Once your tax return has been filed, most of the work is done, but the waiting period can still create uncertainty.

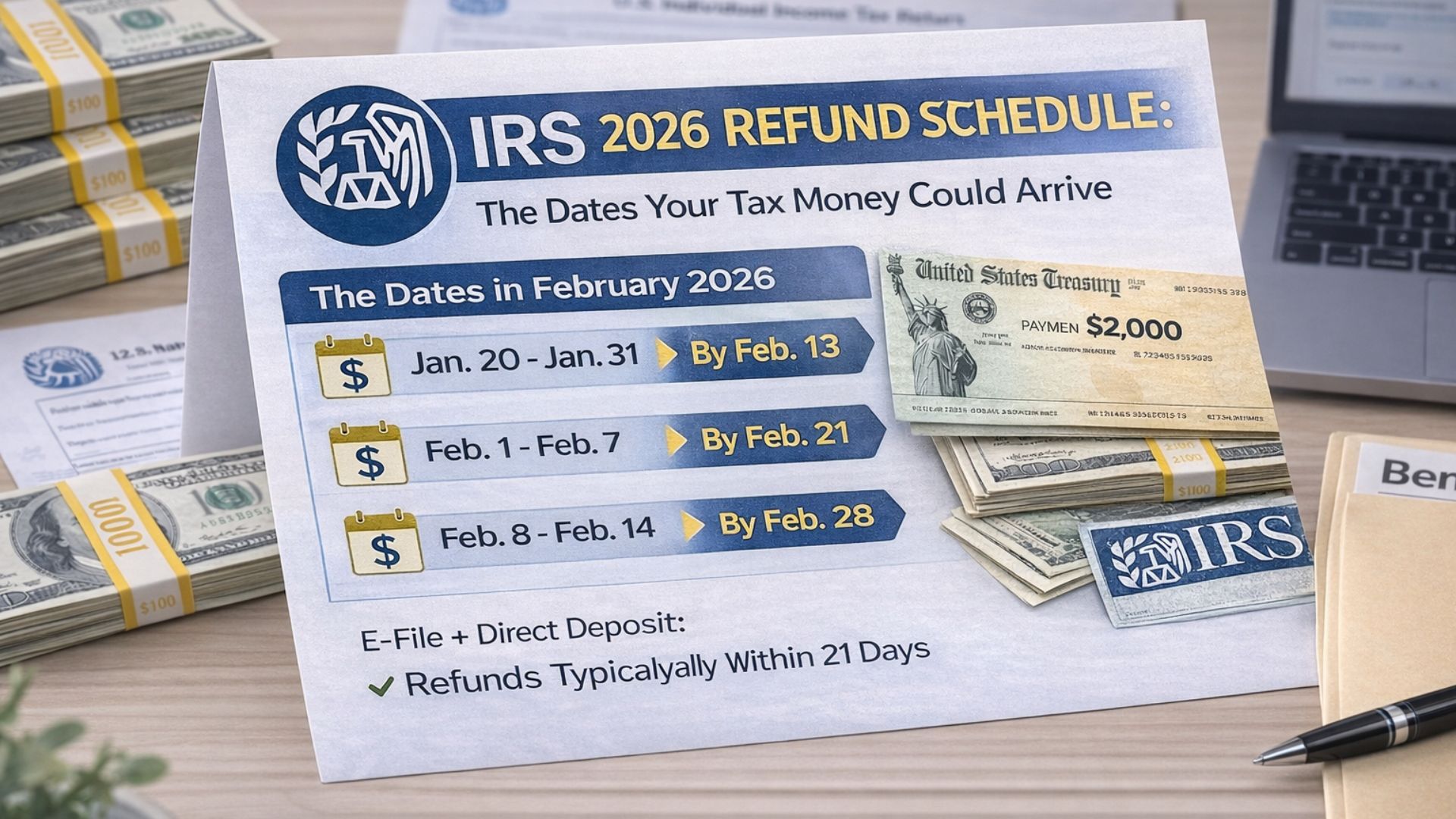

As the 2026 tax season approaches, many taxpayers want to know the exact date their refund will arrive. The IRS usually begins accepting returns toward the end of January. Before that date, there is no official refund calendar because refunds are processed based on when returns are accepted, not on a fixed public schedule. This does not mean the system is random. Instead, it follows a standard processing timeline.

The most important factor in determining refund speed is the acceptance date. When the IRS accepts a return, it means the basic review checks have been completed and the return has entered processing. The IRS states that most refunds are issued within 21 days of acceptance. This estimate mainly applies to taxpayers who file electronically and choose direct deposit as their payment method.

The timing of your submission can also affect processing speed. Returns filed early in the week may move slightly faster through the system. After the refund is approved, direct deposits often reach bank accounts within a few business days. If the payment date falls on a weekend or holiday, the deposit usually appears on the next business day.

Taxpayers can monitor their refund through the official “Where’s My Refund?” tool on the IRS website. This system updates once every 24 hours and shows three stages: return received, refund approved, and refund sent. When the status shows “sent,” direct deposit payments generally arrive shortly afterward. Paper checks, however, take longer and may require several additional weeks for mailing and delivery.

Not every return moves at the same speed. Paper filings require manual handling, which adds time. Mistakes such as incorrect Social Security numbers or mismatched income information can also cause delays. Refunds that include certain tax credits, including the Earned Income Tax Credit or Additional Child Tax Credit, are legally held until mid-February even if approved earlier.

To receive a refund as quickly as possible, taxpayers should file electronically, select direct deposit, and carefully review all personal and banking details before submitting. Filing early, once all documents are ready, can also help reduce waiting time.

Disclaimer: This article is for informational purposes only and does not provide legal, tax, or financial advice. IRS refund timelines and policies may change and depend on individual circumstances. Taxpayers should consult official IRS resources or a qualified tax professional for personalized guidance.